The Official Website of the Province of Davao de Oro

- +084 817 0477

- Mon-Friday: 8:00AM to 5:00PM

Close

Book Now

Contact Info

- Provincial Capitol Compound, Brgy. Cabidianan, Nabunturan, Davao de Oro Province, Philippines 8800

- +084 817 0477

- information@davaodeoro.gov.ph

Provincial Assessor’s Office

Ground Floor, Executive Building, Provincial Capitol, Cabidianan, Nabunturan, Davao de Oro

PASSO@davaodeoro.gov.ph

VISION

MISSION

LEGAL MANDATES

PROGRAMS, PROJECT & ACTIVITIES

MAJOR FINAL OUTPUT

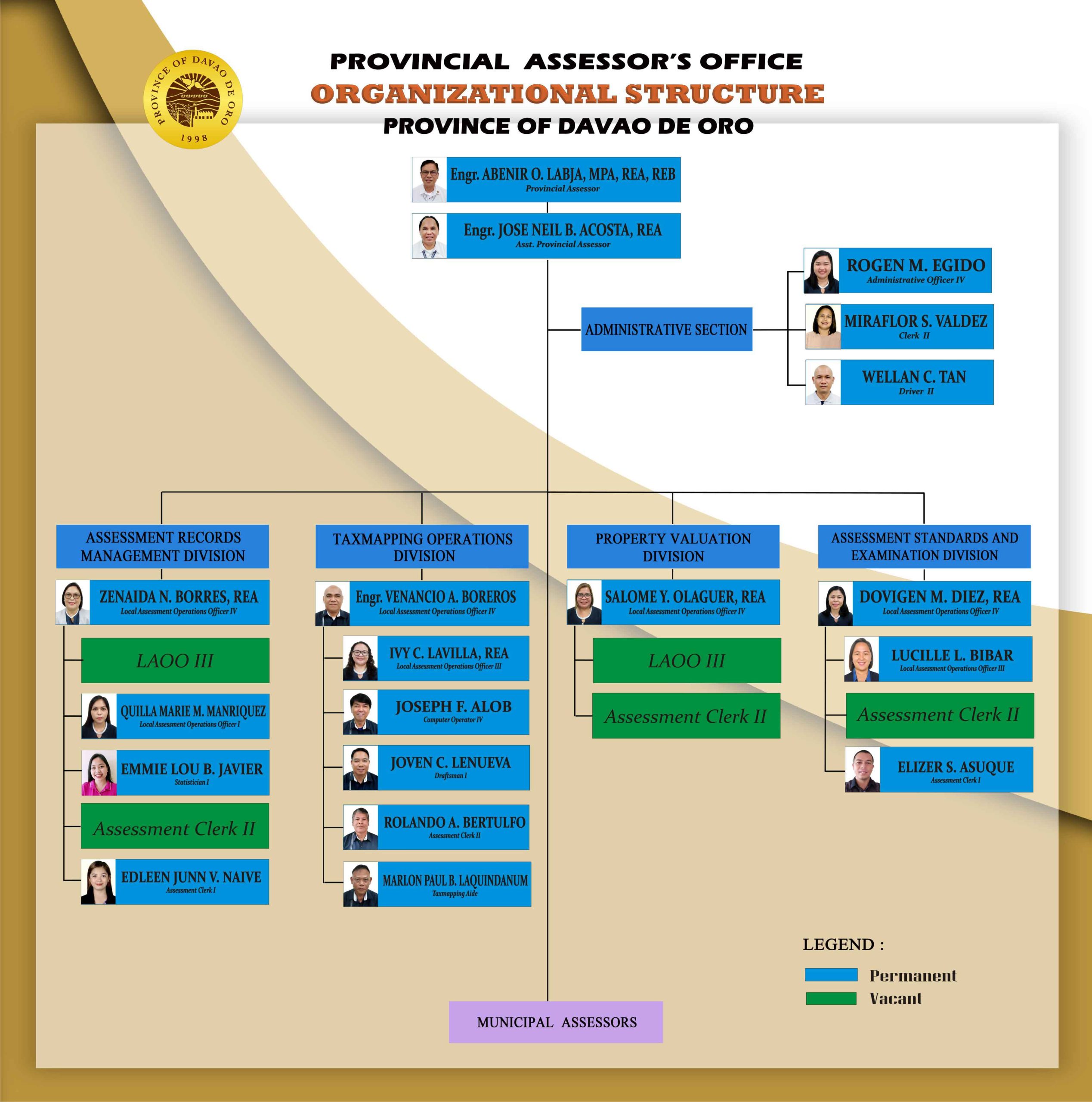

ORGANIZATIONAL STRUCTURE

VISION

PASSO is home to honest, just, competent and technologically-equipped employees with productive management and an effective partner to an increased revenue generation of the local government.

MISSION

The Provincial Assessor’s Office commits to ensure that all laws and policies governing the appraisal and assessment of real properties by taxation purposes are properly

LEGAL MANDATES

The Provincial Assessor’s Office created under the Republic Act 7160 otherwise known as “The Local Government Code of 1991” is mandated to perform the following functions:;

1. Ensure that all laws and policies governing the appraisal and assessment of real properties for taxation purposes are properly executed;

2. Initiate, review and recommend changes in policies and objectives, plans and programs, techniques, procedures and practices in the valuation and assessment of real properties for taxation purposes;

3. Establish a systematic method of real property assessment;

4. Install and maintain a real property identification and accounting system;

5. Prepare, install and maintain a system of tax mapping, showing graphically all properties subject to assessment and gather all data concerning the same;

6. Conduct frequent physical surveys to verify and determine whether all real properties within the province are properly listed in the assessment rolls;

7. Exercise the functions of appraisal and assessment primarily for taxation purposes of all real properties in the local government unit concerned;

8. Prepare a Schedule of Fair Market Value for the different classes of real properties, in accordance with Title Two, Book I of this code;

9. Issue, upon request of any interested party, certified copies of assessment records of real property and all other records relative to its assessment, upon payment of service charge or fee to the treasurer;

10. Submit every semester a report of all assessments as well as cancellations and modifications of assessments to the Local Chief Executive and the sanggunian concerned;

11. Undertake a General Revision of real property assessments every three (3) years;

12. Exercise technical supervision and visitorial functions over all component city or municipal assessors, coordinate with component city or municipal assessors in the conduct of tax mapping operations and all other assessment activities, and provide all forms of assistance thereof: Provided, however, that upon full provision by the component city or municipality concerned to its office of the minimum personnel, equipment and funding requirements as may be prescribed by the Secretary of Finance, such functions shall be delegated to the said city or municipal assessor; and

13. Exercise such other powers and perform such other duties and functions as may be prescribed by law or ordinance.

PROGRAMS, PROJECT & ACTIVITIES

❏ General Revision of Real Property Assessments and Property Classification (under Assessment Records Management Division)

❏ Enhanced Tax Revenue Assessment and Collection System (ETRACS) (under Property Valuation Division)

❏ GIS Integrated Tax Map (under Tax Mapping Division)

❏ Operation Handog Titulo Program (under Examination Division

MAJOR FINAL OUTPUT

*Assessment Records Management Services

o Release Certificate of Landholding and no Landholding

o Real Estate Mortgage Annotation

o Cancellation of previous Field Appraisal and Assessment Sheet (FAAS)/Tax Declaration

o Preparation and submission of Provincial Quarterly Report on Real Property by

Municipality

o Filing and bookbinding of approved Field Appraisal and Assessment Sheet (FAAS) of

the 11 municipalities

o Notice of Cancellation acted

o Approved Field Appraisal and Assessment Sheet (FAAS) recorded

*Property Valuation Services

o Preparation of Appraisal Report

o Cancellation of Assessment

o Process Field Appraisal and Assessment Sheet (FAAS) for approval by the Provincial

Assessor

o Inspection of Real Property Units

o Preparation of Inspection Report

o Reclassification of Assessment

o Preparation of FAAS, Tax Declaration and Notice of Assessment on newly discovered

Real Property

o Preparation of Schedule of Fair Market Values

*Tax mapping Services

o Update and file Tax Map Control Roll (TMCR)

o Reflect/update Property Identification Map

o Scanning, digitizing and printing of tax maps

o Conduct tax mapping assessment audit

ORGANIZATIONAL STRUCTURE

OFFICIAL MESSAGE OF THE DEPARTMENT HEAD

Provincial Assessor’s Office is the key office that takes charge in the real property of the entire

Provincial Government of Davao de Oro. Hence, the office establishes a methodical and

systematic real property tax management and administration of a progressive and financially

stable province with fair, just and reasonable assessment and effective collection of Real

Property Tax.

Real Property Tax contributes tax revenues to all local government units. It is one of the primary sources of funds to finance local development programs and projects.

The Provincial Assessor’s Office conforms to the procedures in accordance with the Manual on Real Property Appraisal and Assessment Operations (MRPAAO) which serves as a guiding tool to effectively educate the constituents on the merits of a rational and responsive real property assessment and appraisal system.

The Provincial Assessor’s Office was created when the province of Compostela Valley now Davao de Oro was carved out of Davao del Norte province by virtue of Republic Act No. 8470, signed by Fidel V. Ramos on January 30, 1998 and was ratified through a plebiscite conducted in the twenty-two (22) municipalities of the mother province on March 7, 1998.

Real Property Tax (RPT) is the lifeblood of the Provincial Local Government Unit. For continuous development of our community and nation as a whole, all real property units should be properly listed and all property owners should pay taxes on time.

Real Property Tax contributes tax revenues to all local government units. It is one of the primary sources of funds to finance local development programs and projects.

The Provincial Assessor’s Office conforms to the procedures in accordance with the Manual on Real Property Appraisal and Assessment Operations (MRPAAO) which serves as a guiding tool to effectively educate the constituents on the merits of a rational and responsive real property assessment and appraisal system.

The Provincial Assessor’s Office was created when the province of Compostela Valley now Davao de Oro was carved out of Davao del Norte province by virtue of Republic Act No. 8470, signed by Fidel V. Ramos on January 30, 1998 and was ratified through a plebiscite conducted in the twenty-two (22) municipalities of the mother province on March 7, 1998.

Real Property Tax (RPT) is the lifeblood of the Provincial Local Government Unit. For continuous development of our community and nation as a whole, all real property units should be properly listed and all property owners should pay taxes on time.

JOSE NEIL B. ACOSTA

Acting Provincial Assessor